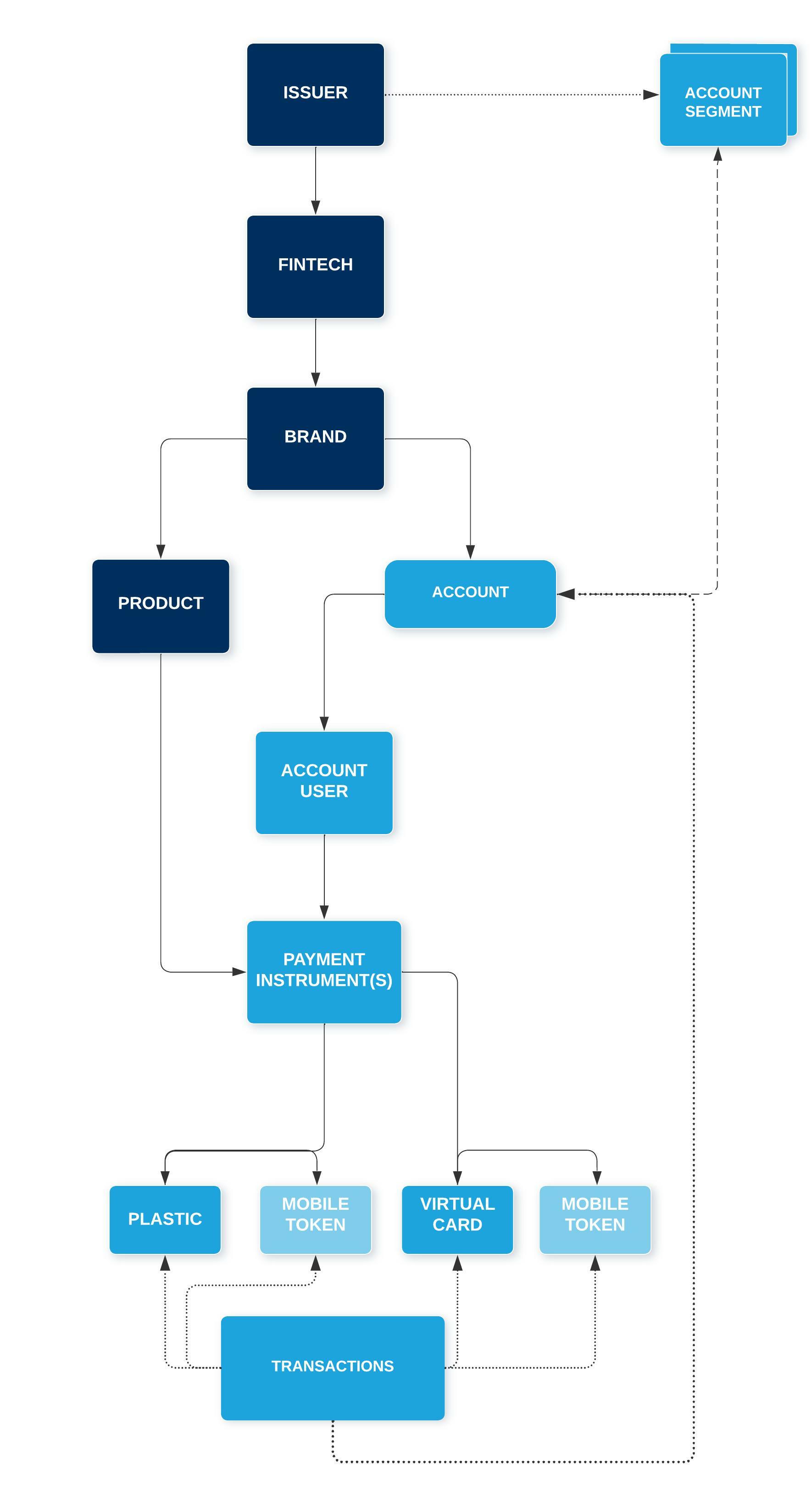

Account Structure for Consumers

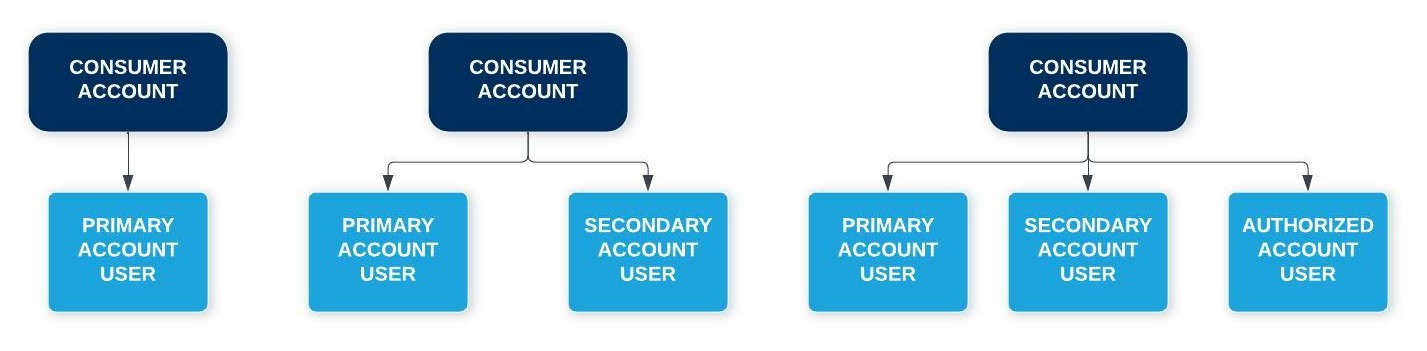

Consumer products can have either primary accounts or joint accounts.

PCaaSA Consumer Account Hierarchy

-

Primary Account User:

A Primary Account User is always set up for an individual responsible for credit checks and payment. -

Secondary Account User:

A Secondary Account User may be set up for individuals with joint responsibility for credit checks and payment. -

Authorized Account User:

An Authorized User Account may be set up for individuals who have the authorization to make purchases but the responsibility for credit checks and payment is with Primary (and Secondary) Accounts.-

Sam is a 14-year-old and his parents have a joint account. Sam is added as an authorized user by his parents so he can have a credit card to use in emergency situations. Although Sam can make purchases using the card, he is not responsible for making payments or credit checks. This responsibility falls on his parents who are the joint account owners.Example of an authorized user:

-

Payment Instrument:

A Payment Instrument (or PI) is the object that facilitates the flow of transactions between the account and the merchant. A PI can be created for either a physical card or for a virtual card. Both physical and virtual cards can have associated mobile tokens for digital wallets (i.e., Apple Pay, Samsung Pay and Google Pay). An Account User can have one or more PIs associated to it.

-

Plastic:

A Plastic object is a physical card associated to a PI. A Plastic can either be magstripe only type or contact EMV Chip or contactless EMV chip.

-

Virtual card:

A Virtual card is a digital card number without a physical plastic. It can be used to make purchases online, over the phone, and provisioned on a digital wallet.

-

Mobile Token:

A Mobile Token is generated when a PI is provisioned to a digital “pay” wallet and is a unique identifier used to associate transactions to the digital wallet.

Updated 10 months ago